On June 19th, 2024 Nvidia became the world’s most valuable company. Its rise has been stunning, up 181% so far in 2024 and taking only three months to add US$1 billion in market capitalisationi. While some of the other US-based megacap tech stocks have also seen impressive share price rises this year – Meta +44%, Alphabet +26%, Microsoft +20%ii – Nvidia’s explosive growth has left them looking like laggards.

While most investors’ attention has been drawn to the individual stocks, the incredible growth of these very large companies has also driven significant increases in indices that contain these names, including the S&P500, the NASDAQ and the global MSCI indexes.

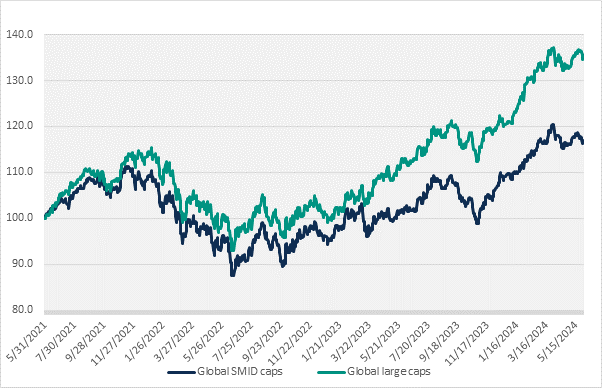

Global large caps have out-performed in recent years

The impressive performance of the megacap tech stocks has driven large-cap indices to outperform mid and small cap indices over the past three years as can be seen in the graph below.

Global large caps vs global small-mid caps (SMIDs)

Total return of MSCI ACWI vs MSCI ACWI SMID in AUD from 06 2021 to 05 2024. Source: Morningstar Direct

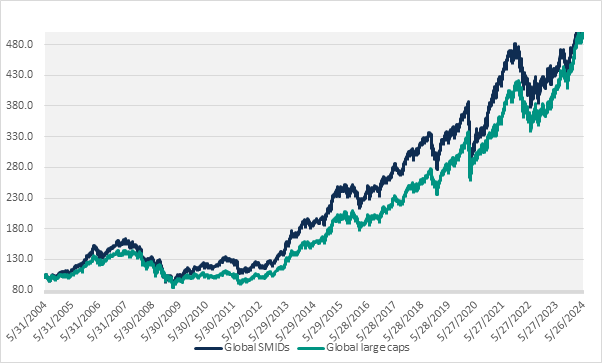

However, if you take a longer-term view you can see that this recent outperformance is unusual. The chart below shows that for most of the last 20 years global SMIDs outperformed global large caps, only closing the gap when mega-cap tech companies surged.

Total return of MSCI ACWI vs MSCI ACWI SMID in AUD from 06 2004 to 05 2024. Source: Morningstar Direct

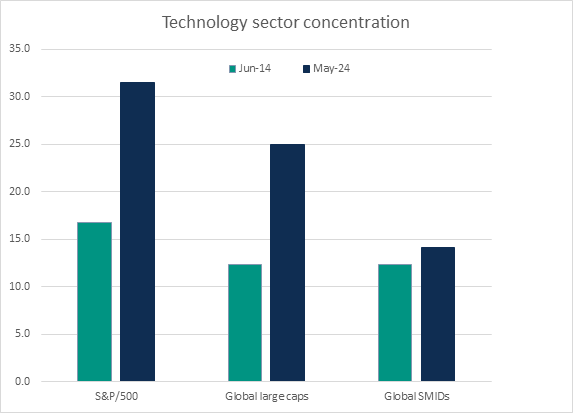

Large cap indices are now increasingly concentrated

The incredible success of megacap tech has also led to the large-cap indices becoming increasingly concentrated in technology as the charts below show.

Source: Morningstar Direct, as of 20 June, 2014 and 31 May, 2024

In 2014, the technology concentration of all three indices was reasonably similar, however now in May 2024 technology makes up more than 30% of the S&P 500 and 25% of the global large cap index. The global SMID index has stayed relatively consistent, rising from 12% to 14%.

The increased concentration of the large cap indices is a concern for investors that prize diversification as a way of decreasing risk and reducing the volatility of their investment returns. The SMID index remains more diversified than the large cap index, and of course active managers can construct portfolios which are better diversified than the index through considered stock selection.

Can large caps continue to outperform?

This is the key question for investors. According to Vaughan Nelson Portfolio Manager James Eisenman:

“Large cap names have been largely driven by excitement around AI, while the tangible benefits of implementing the technology have yet to be seen. If AI is over-hyped and needs time to mature as a technology, then large cap tech could give back some of its recent outperformance. However, if new use cases are developed quickly then the tangible benefits of AI could provide an outsized benefit to small companies by allowing them to scale their operations more efficiently as they grow.”

While the question of whether large cap outperformance will continue can only be answered in the future, James Eisenman thinks all investors should be aware of, and adjust to, the new market dynamics.

“Due to the incredible success of the AI-related megacaps the stock market has changed significantly in a short period of time and all investors should be looking at their investment portfolios and deciding whether they need to adjust or rebalance them to align with their investment plans. These market movements have also created great opportunities for active managers and stock pickers to out-perform their benchmarks over the long-term. Any big market changes are opportunities which active managers and astute investors can capitalise on. This year we have been able to open positions in companies that will benefit from the success and growth of AI, but are trading at much lower multiples.”

___________________________________________________________

i Reuters, 19 June, 2024. ‘Nvidia becomes world’s most valuable company’

ii Stats as of 19 June

This publication (the material) has been prepared and distributed by Natixis Investment Managers Australia Pty Limited AFSL 246830 for the Vaughan Nelson Global Equity SMID Fund (the “Fund”) and may include information provided by third parties. The information in this report is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited AFSL 229988 is the responsible entity of the unquoted and quoted class units of the Fund. Vaughan Nelson Investment Management, L.P. is the investment manager. This information should not be relied upon in determining whether to invest or continue to invest in the Fund and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Fund, an investor should consider the current PDS and Target Market Determination for the appropriate class of the Fund, available on the website www.VaughanNelson.com.au or by contacting us on 1300 219 207. Past performance is not a reliable indicator of future performance. There is no guarantee the performance of the Fund or any particular rate of return. It may not be reproduced, distributed or published, in whole or in part, without the prior written consent of Natixis Investment Managers Australia Pty Limited and IML.

Stay up to date

with Vaughan Nelson

Register to receive regular performance updates and regular insights from the Vaughan Nelson investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

Vaughan Nelson Investment Management marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Vaughan Nelson Investment Management, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.