Inflation may have peaked in late 2022 but exactly where interest rates will end up, and when they’ll start coming down again, is anyone’s guess. The ongoing US banking crisis shows how the rapid increase in US interest rates is putting increasing pressure on the US economy and causing things to break in unintended ways.

Exactly how this will play out, and how this will impact other parts of the US economy, is still unclear. Ongoing macro-economic friction makes the future even murkier, with the war in Ukraine showing no sign of finishing and geo-political tension between China and the US increasing.

It’s no wonder sharemarkets are volatile right now. However, while this volatility creates uncertainty for investors, it also creates opportunity. For Chris Wallis, CIO and CEO of Vaughan Nelson, it’s bringing some of the fun back to investing after the very long bull market drove all shares higher.

“Quite frankly, for the first time in well over 10 years, we’re having a lot of fun. It’s not fun when everybody gets a trophy for just owning equities because everything goes up. You’ve got to know what you’re doing now. And so, in that sense, we like the volatility, we’re enjoying it.”

While volatility creates opportunity, it also creates an avalanche of information which can be tricky for investors to navigate. While there is a lot of talk about a recession, investors should focus more on an earnings recession than an economic recession because earnings will drive asset prices, whether that’s in equities or fixed income.

Is now the time to invest in global small and mid-cap companies?

Chris Wallis expects a rotation towards value stocks as investors that are “crowded into large cap tech stocks” move towards industrials and other cycles. In this environment Chris believes that global small and mid-caps are likely to outperform, for two reasons:

- They are undervalued compared to large caps right now.

- They are likely to benefit more from any government fiscal response to a faltering economy.

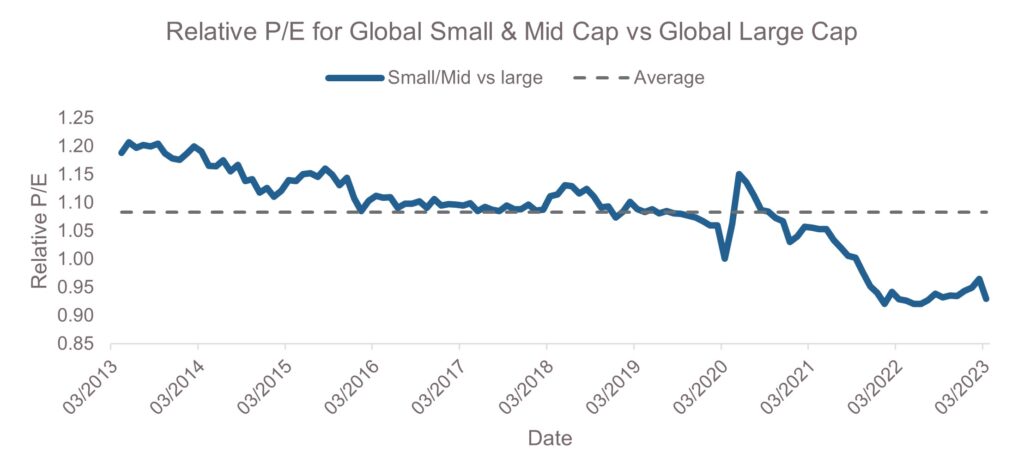

If that thesis is right, investors should consider increasing the small-cap exposure in their portfolios – a part of the market that significantly devalued when sharemarkets fell. As the graph below shows, valuations in the small and mid-cap space are at a significant discount to their historical relative valuation vs large caps.

Source: Factset. Relative P/E calculated by dividing the MSCI ACWI SMID P/E by the MSCI ACWI P/E for each month from 1/4/2013 – 31/3/2023. Past performance is not a reliable indicator of future performance.

Which stocks and sectors does Vaughan Nelson favour in these times?

The Vaughan Nelson Investment Team looks across all sectors and geographic areas to find opportunities that meet its investment objectives. In the current environment the Vaughan Nelson Global SMID Fund is more weighted towards B2B service companies, with lower exposure to companies that rely on consumer discretionary spending. The Fund also has little exposure to banks right now, preferring insurance brokers, services, and data providers in the financial sector, but otherwise is finding good value across a range of different industries and countries.

The Vaughan Nelson Investment Team looks across all sectors and geographic areas to find opportunities that meet its investment objectives. In the current environment the Vaughan Nelson Global SMID Fund is more weighted towards B2B service companies, with lower exposure to companies that rely on consumer discretionary spending. The Fund also has little exposure to banks right now, preferring insurance brokers, services, and data providers in the financial sector, but otherwise is finding good value across a range of different industries and countries.

Jim Eisenman, the Portfolio Manager for Vaughan Nelson’s Global SMID fund nominates undervalued growth companies, also knowns as ‘compounders’ as among the type of stocks he is feeling most bullish about right now:

“I think these types of companies are well set up for continuing strong growth for several years. They can be from different industries and different countries, but the businesses share many similar qualities.

They are all well positioned within growing industries, they’re undervalued by the market, have strong recurring revenue and high visibility into their earnings over the next 12 months. They also have strong management teams, continue to improve their return on capital over time and have great growth prospects through a combination of organic growth and strategic acquisitions. Three companies that really fit this description in our Fund are Avantor, Entegris and Vamos Locacao.”

Three undervalued growth companies for volatile times

Avantor (NYSE: AVTR)

Avantor is a US-based global distributor of products and services to the Life Sciences and other industries – for example equipment and consumable products used to run lab tests and analyze samples and services around data collection and compliance.

The company is well positioned within a growing industry and has scale advantages over smaller peers. This has allowed it to successfully improve margins over time through maximizing its operating leverage as well as by selling an increasing amount of its own products. Currently Avantor distributes around 30% of its own products and 70% third-party products – and management thinks it can get closer to 50/50 split. Margins on its own products are significantly higher than third-party products, which provides a tailwind to improving Avantor’s overall margins as the mix of products sold shifts over time.

When you combine margin growth with strong recurring revenue (circa 85%), high visibility into future cash flows, and an industry growing at 3-5% p.a., Avantor looks well positioned to be able to compound returns for many years to come.

Entegris (NASDAQ: ENTG)

Entegris, Inc. is a world-class supplier of advanced materials and process solutions for semiconductors, life sciences, and other high-tech industries.

80% of its revenue is from products that are consumable and tied to the production of silicon wafers, which are critical to the production of semiconductors. As semiconductors increase in complexity and shrink in size, it increases Entegris’s revenue per wafer, allowing it to grow faster than the industry overall. While growth in the semiconductor industry was lower than expected in 2022, the industry tends to be cyclical, and its long-term growth projections remain very attractive.

As another benefit to Entegris’ growth prospects, it recently acquired CMC materials, which further strengthened its portfolio and positioning within the supply chain. All of this has the company well positioned for strong long-term growth.

Vamos Locacao (BVMF: VAMO3)

Vamos Locacao is the market leader in the truck and capital equipment rental industry in Brazil. It’s three times larger than its biggest competitor, with a market cap close to US$1 billion

Rental products include on-road tractors, trailers, and box trucks, as well as heavy and semi-heavy off-road vehicles, while it also provides a variety of maintenance and other services to support the rental fleet.

By leveraging its scale, Vamos can purchase vehicles at a 30% discount to retail pricing and it has better access to capital than many of its competitors or customers. It is also increasing its total revenue per transaction by providing ancillary products and services to customers.

The rental industry is very young in Brazil and the company is growing rapidly and expanding its lead in the market, and its scale advantages, each year. It grew earnings 40% last year and is expected to grow 30% this year and is currently trading at around 15 times earnings. Vamos should continue to benefit from structural growth as the industry continues to grow and develop.

Investors should be ready to move their capital

No one can forecast exactly how the coming months and years will play out for investors, but there are several indications that global small and mid-cap companies could offer an attractive opportunity for investors. Chris Wallis believes the opportunity is compelling.

“Global small-cap stocks are trading at 15% to 20% below their long-term valuation averages. They have more attractive valuations and better organic growth than many of their large-cap peers. Small and mid-cap value stocks, in particular, look very attractive, as they are cheap on an absolute and relative basis.

If investors are not already making allocations to the space, they need to start thinking about getting more cyclical and getting ready to move. Given the potential range of outcomes ahead, we’re not quite all in yet, we’re still holding a bit of cash…should be a fun rest of the year.”

This information is provided for general information purposes only and does not take into account the investment objectives, financial situation or needs of any person. Investors Mutual Limited (AFSL 229988) is the issuer and responsible entity of the Vaughan Nelson Global Equity SMID Fund and the Vaughan Nelson Global Equity SMID Fund (Quoted Managed Fund) (‘Funds’). Vaughan Nelson Investment Management, L.P. is the investment manager.

This information should not be relied upon in determining whether to invest in the Funds and is not a recommendation to buy, sell or hold any financial product, security or other instrument. In deciding whether to acquire or continue to hold an investment in the Funds, an investor should consider the current Product Disclosure Statement and Target Market Determination for the appropriate class of the Fund, available on the website www.VaughanNelson.com.au or by contacting us on 1300 219 207.

Past performance is not a reliable indicator of future performance. Investments in the Funds are not a deposit with, or other liability of, Investors Mutual Limited and are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Investors Mutual Limited does not guarantee the performance of the Funds or any particular rate of return.

Stay up to date

with Vaughan Nelson

Register to receive regular performance updates and regular insights from the Vaughan Nelson investment team, featured in the Natixis Investment Managers Expert Collective newsletter.

Vaughan Nelson Investment Management marketing in Australia is distributed by Natixis Investment Managers, a related entity. Your subscriber details are being collected on behalf of Vaughan Nelson Investment Management, and Investors Mutual Limited (the RE for Fund) by Natixis Investment Managers Australia. Please refer to our Privacy Policy. Natixis Investment Managers Australia Pty Limited (ABN 60 088 786 289) (AFSL No. 246830) is authorised to provide financial services to wholesale clients and to provide only general financial product advice to retail clients.